Calculate the amount you’ll save in your pockets by switching to solar. Enter your monthly electric bill and we’ll generate your estimated savings from solar.

Solar Incentives that help you save!

Take advantage of one of the most generous solar savings options! Right now, you can receive a 30% Federal Tax Credit to offset income taxes with a residential or commercial solar installation. With these incentives, going solar can be a great way to save money and reduce your environmental impact.

Avoid high costs with Solar Financing!

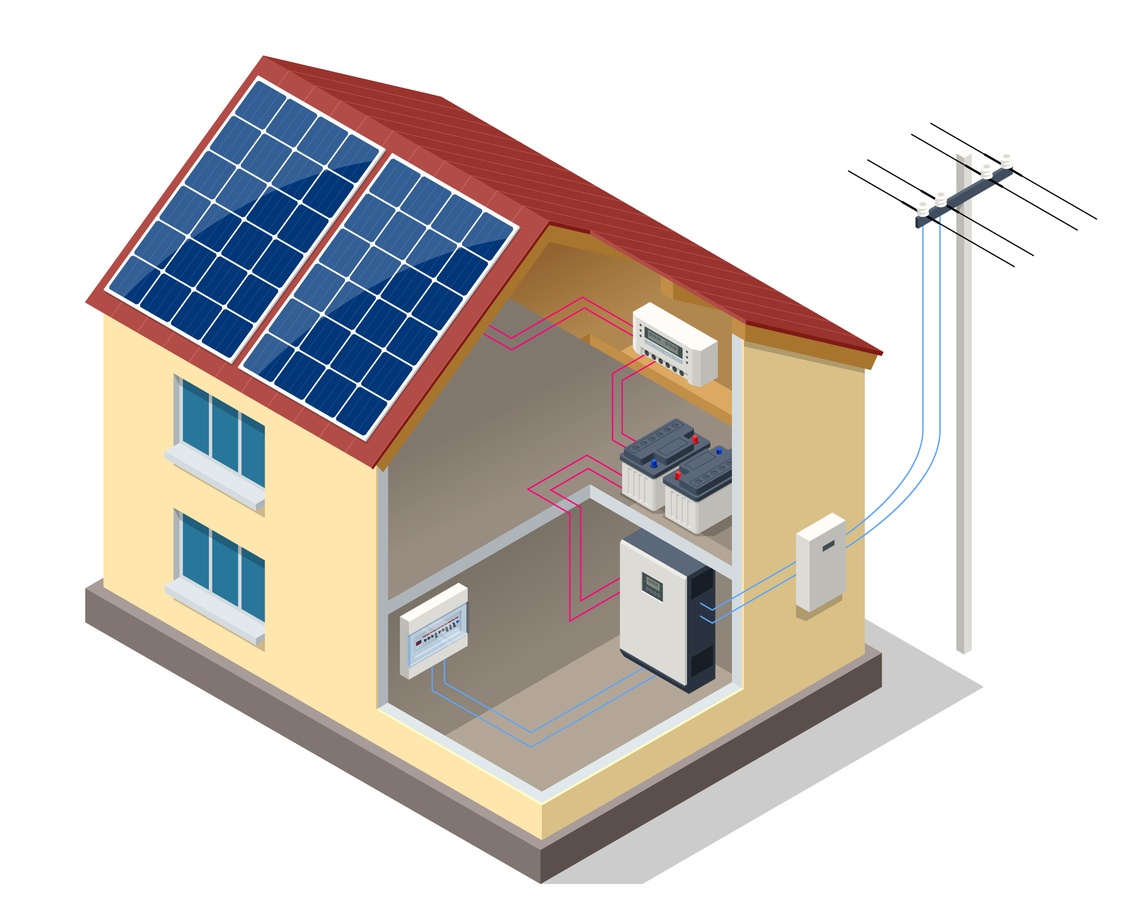

High upfront cost is one of the biggest fears people have about switching to solar. NJ Solar Power offers a variety of solar savings options to accommodate your financial situation. No matter what financing option you choose, you’ll be getting the same great customized system to take some of the stress out of those monthly power bills.

If you are considering going solar, be sure to contact us today to learn more about the savings and benefits that are available to you.